UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

(Mark One)

For the fiscal year ended

For the transition period from ______to _____

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction | (I.R.S. Employer | |

| of incorporation or organization) | Identification No.) |

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “ large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | |

| Emerging Growth

Company | ||

| Smaller Reporting Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐

NO

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant was approximately $

As

of April 28, 2025 there were outstanding

Documents Incorporated by Reference

None.

EXPLANATORY NOTE

SUNation Energy, Inc. (herein referred to as “SUNation Energy,” “SUNE,” “our,” “we” or the “Company”) is filing this Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) to amend our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “Original Filing”), filed with the U.S. Securities and Exchange Commission (“SEC”) on April 15, 2025 (the “Original Filing Date”), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Amendment No. 1 also contains new certifications by our principal executive officer and principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15 of Part IV is amended and restated to include the currently dated certifications as exhibits.

Except as expressly noted in this Amendment No. 1, this Amendment No. 1 does not reflect events that may have occurred subsequent to the Original Filing Date or modify or otherwise update any other disclosures contained in the Original Filing, including, without limitation, the financial statements. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Filing.

TABLE OF CONTENTS

i

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

INFORMATION REGARDING DIRECTORS

The following sets forth information regarding the Company’s current directors (the “Board of Directors” or “Board”), including information regarding their principal occupations currently and for the preceding five years, as well as discussion of the specific experience, qualifications, attributes and skills that led to the conclusion that such person should serve as director of the Company. There are no family relationships between any director or executive officer.

Spring Hollis, age 52, is the Chief Executive Officer and founder of Star Strong Capital, an investment firm that provides flexible capital solutions to lower middle market businesses, a position she’s held since 2019. Before founding Star Strong Capital, Ms. Hollis was a Managing Director at Deutsche Bank focused on principal investments in structured credit and esoteric assets from 2000 to 2010. Prior to her time at Deutsche Bank, beginning in 2000, her experience also included Park Cities Asset Management as a specialty finance Portfolio Manager and Briargate Capital as a Founding Partner focused on distressed issuers of privately held debt. Ms. Hollis also serves on the Board of Directors for the BOMA Project, an international non-profit focused on the economic empowerment of women in sub-Saharan Africa. Ms. Hollis has a J.D. from New York University and a B.A. in philosophy from the University of Wisconsin-Madison. We believe Ms. Hollis’ experience in banking and finance qualifies her to serve on our Board of Directors, and in her capacity as an independent board member.

Henry B. Howard, age 68, is President and Chief Executive Officer of U.S. Renewable Energy, LLC and U.S. Renewable Energy II, LLC, a position which he has held since 2018. Mr. Howard is the founder and majority owner of U.S. Mortgage Finance Group, positions which he has held since 2005. In addition, Mr. Howard has also been the founder and sole owner of U.S. Education Finance Group since 1999. Mr. Howard graduated from University of Maryland in 1979 with a Bachelor’s degree in Economics and Political Science (cum laude). He also received a Doctor of Humane Letters (h.c.) from the University of Mobile, Alabama. We believe Mr. Howard is qualified to serve on our Board of Directors due to his business experience, and in his capacity as an independent board member.

Roger H.D. Lacey, age 74, has been a director of Communications Systems, Inc. (“CSI”) since 2008 and a director of ours, and our chairman, since the merger of the Company and CSI (the “Merger”) in March 2022. Mr. Lacey served as CSI’s chief executive officer from February 2015 until November 30, 2020, and served as the executive chairman of CSI’s board of directors beginning in December 2018. He also assumed the additional role of interim chief executive officer of CSI on August 2, 2021 through March 28, 2022. Mr. Lacey also served as interim chief executive officer of CSI from June 2014 until February 2015. Mr. Lacey was senior vice president of strategy and corporate development at the 3M Company from 2009 to his retirement in 2013. He was the 3M Company’s chief strategy officer and head of global mergers and acquisitions from 2000 to 2013. Mr. Lacey’s career with 3M began in 1975; from 1989 to 2000 he held various senior positions including serving as division vice president of 3M Telecom Division. In addition, Mr. Lacey served as a member of the corporate venture capital board for internal and external new venture investments from 2009 to 2013. In addition, he is a board member of Johnsonville Sausage Corporation, a leading US food company, and also a Senior Partner in CGMR Capital, a private equity firm, where he is a Board member of WTB, a private Utilities services company, and Cambek, a leading manufacturer of specialty wood construction products. He was formerly a member of the board of governors for Opus Business School, University of St. Thomas; a former visiting professor of strategy and corporate development, Huddersfield University; a founding member of the Innovation Lab at MIT; and is a former vice chair of Abbott Northwestern Hospital Foundation. We believe that Mr. Lacey is qualified to serve on our Board of Directors due to his unique perspective that combines familiarity with key technology markets around the world combined with deep experience in strategic planning and business development. Beginning in 2025, Mr. Lacey is deemed to be an independent board member.

Scott Maskin, age 61, has served on our Board of Directors since November 2022 and as our CEO since May 2024. Prior to that he was our Senior Vice President and General Manager, New York Division from November 2022 to May 2024. Mr. Maskin is the co-founder of SUNation Energy, and served as its chief executive officer since its inception in June 2003 until the Company’s acquisition of SUNation in November 2022. Previously Mr. Maskin developed nearly 20 years of experience on electrical and contracting work on commercial and residential properties and has a Master Electrician’s license. We believe Mr. Maskin is qualified to serve on our Board of Directors due to his extensive experience and knowledge in the industry, particularly related to solar and battery energy storage systems for residential and small commercial customers.

1

Kevin O’Connor, age 62, is the Principal at KMO Strategy. Kevin O’Connor is currently involved in strategic consulting, He previously served as the Chief Executive Officer of Dime Community Bank the successor organization to BNB Bank after the merger between these two organizations in 2021. Dime Bank is one of the region's largest community banks with over 50 branches, 800 employees and $12 billion in assets. Mr. O’Connor served as the Chief Executive Officer of the bank for 16 years, where he led the Long Island community institution through a period of dramatic growth and financial stability. Other roles in financial services included senior positions at North Fork Bank and KPMG. Mr. O’Connor has degrees in Accounting from Adelphi University in 1984 and Suffolk Community College. We believe that Mr. O’Connor is qualified to serve on our Board of Directors due to his business and management experience, and in his capacity as an independent board member.

CORPORATE GOVERNANCE AND BOARD MATTERS

General Information

Our Board is committed to sound and effective corporate governance practices. Our governance policies are consistent with applicable provisions of the rules of the SEC and the listing standards of the Nasdaq Capital Market (“Nasdaq”). We also periodically review our governance policies and practices in comparison to those suggested by authorities in corporate governance and the practices of other public companies. You can access the charter of our Audit and Finance Committee, the charter of our Compensation Committee, the charter of our Nominating and Corporate Governance Committee Guidelines by following links on the “Investor Relations—Governance” section of our website at ir.sunation.com.

Meetings of the Board of Directors

Our Board of Directors held twenty-one formal meetings during 2024. The independent directors regularly hold executive sessions at meetings of our Board of Directors.

During 2024, each of the directors then in office attended at least 75% of the aggregate of all meetings of the Board of Directors and all meetings of the committees of the Board of Directors on which such director then served. Each of our directors is expected to make a reasonable effort to attend our annual meetings of shareholders. Of our directors then in office, Messrs. Lacey and Maskin attended the 2024 Annual Meeting of Shareholders, which was held virtually.

Committees of the Board of Directors

The Company has three standing committees of the Board of Directors: the Audit and Finance Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Audit and Finance Committee

The members of the Audit and Finance Committee are Kevin O’Connor (Chair), Spring Hollis and Henry Howard. Our Board of Directors has determined that each member of the Audit and Finance Committee is independent under applicable SEC rules and Nasdaq listing standards. Our Board of Directors has determined that Mr. O’Connor is an audit committee financial expert, as defined under the applicable rules of the SEC. Each of the members of our Audit and Finance Committee meets the requirements for financial literacy and possesses the financial qualifications required under applicable SEC rules and Nasdaq listing standards. The Audit and Finance Committee met four times during 2024.

The Audit and Finance Committee is responsible for the engagement, retention and replacement of the independent registered public accounting firm, approval of transactions between the Company and a director or executive officer unrelated to service as a director or officer, approval of non-audit services provided by our independent registered public accounting firm, oversight of our internal controls and the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters. Our independent registered public accounting firm reports directly to the Audit and Finance Committee.

2

The Audit and Finance Committee operates under a written charter approved by the Board, a copy of which is available in the “Investor Relations—Governance” section of our website at ir.sunation.com.

Compensation Committee

The members of the Compensation Committee are Henry Howard (Chair), Spring Hollis and Kevin O’Connor. Our Board of Directors has determined that each member of the Compensation Committee is independent under applicable SEC rules and Nasdaq listing standards. The Compensation Committee met four times during 2024.

The Compensation Committee is responsible for the overall compensation strategy and policies of the Company; reviews and approves the compensation and other terms of employment of our chief executive officer and other executive officers; oversees the establishment of performance goals and objectives for our executive officers; administers our incentive compensation plans, including the Company’s 2022 Equity Incentive Plan; considers the adoption of other or additional compensation plans; and provides oversight and final determinations with respect to our 401(k) plan, employee stock ownership plan and other similar employee benefit plans.

The Compensation Committee operates under a written charter approved by the Board, a copy of which is available in the “Investor Relations—Governance” section of our website at ir.sunation.com.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Spring Hollis (Chair), Henry Howard, and Kevin O’Connor. Our Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent under applicable SEC rules and Nasdaq listing standards. The Nominating and Corporate Governance Committee met one time during 2024.

The Nominating and Corporate Governance Committee is responsible for identifying, reviewing and evaluating candidates to serve on the Board of Directors; evaluating our incumbent directors; recommending candidates to our Board for election to the Board of Directors; making recommendations to the Board regarding the membership of the committees of the Board; assessing the performance of the Board; reviewing succession planning of the Chief Executive Officer and other senior executives; and overseeing matters of corporate governance.

The Nominating and Corporate Governance Committee operates under a written charter approved by the Board, a copy of which is available in the “Investor Relations—Governance” section of our website at ir.sunation.com.

Director Nominations

When evaluating candidates for service as a director, the Nominating and Corporate Governance Committee and the Board take into account many factors, including relevant experience, integrity, ability to make independent analytical inquiries, stock ownership, understanding of the Company’s business, relationships and associations related to the Company’s business, personal health and a willingness to devote adequate time and effort to Board responsibilities in the context of the needs of the Board at that time.

The Board seeks individuals who reflect appropriate background, education, business experience, skills, business relationships and associations and other factors that will contribute to the Board’s governance of the Company.

The Board will consider candidates proposed by shareholders and evaluates them using the same criteria as for other candidates. A shareholder who wishes to recommend a director candidate for consideration by the committee should send the name(s) and appropriate biographical information regarding the proposed candidate(s) to the Nominating and Corporate Governance Committee at the Company’s principal executive office, 171 Remington Boulevard, Ronkonkoma, NY 11779. A shareholder who wishes to nominate an individual as a director for election, rather than recommend the individual to the Board as a candidate, but does not intend to have the nominee included in our proxy materials, must comply with the advance notice requirements set forth in our Bylaws.

3

Board Leadership

Mr. Lacey serves as our Chairman of the Board. The Chairman of the Board position is a non-executive position and is separate from the position of Chief Executive Officer. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead our Board in its fundamental role of providing advice to and independent oversight of management. Our Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as the Board’s oversight responsibilities continue to grow. Our Board believes that having separate positions, with a non-executive director serving as Chairman, is the appropriate leadership structure for our Company at this time and allows each of the positions to be carried out more effectively than if one person were tasked with both the day-to-day oversight of our business as well as leadership of our Board.

Board’s Role in Managing Risk

In general, management, particularly senior management and individual managers, is responsible for the day-to-day management of the risks the company faces. This includes identifying, assessing, and controlling threats to the organization's capital, earnings, and operations, while the Board, acting as a whole and through the Audit and Finance Committee, has oversight responsibility for risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Members of senior management attend the regular meetings of the Board and are available to address questions and concerns raised by the Board related to risk management. In addition, the Board holds regular discussions with management, the Company’s independent registered public accounting firm and the internal auditor, to identify major risk exposures and assess their potential financial impact on the Company and develop steps that could be taken to manage these risks.

The Audit and Finance Committee assists the Board in fulfilling its risk management oversight responsibilities in financial reporting, internal controls and compliance with legal and regulatory requirements. The Audit and Finance Committee reviews the Company’s financial statements and meets with the Company’s independent registered public accounting firm and internal auditor at least four times each year to review their respective reports on the adequacy and effectiveness of our internal audit and internal control systems, and to discuss policies with respect to risk assessment and risk management.

Code of Ethics and Business Conduct

The Company maintains a Code of Ethics and Business Conduct (the “Code of Ethics”) applicable to all of the Company’s officers, directors, employees, and other representatives. A copy of the Code of Ethics is available in the “Investor Relations—Governance” section of our website at ir.sunation.com. We intend to disclose any amendments to our Code of Ethics, or waivers of its requirements granted to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, on our website.

Communications with the Board of Directors

Any shareholder who desires to contact our Board of Directors may do so by writing to the Board of Directors, generally, or to an individual director at SUNation Energy, Inc., 171 Remington Boulevard, Ronkonkoma, NY 11779. Communications received electronically or in writing are distributed to the full Board of Directors, a committee or an individual director, as appropriate, depending on the facts and circumstances described in the communication received. By way of example, a complaint regarding accounting, internal accounting controls or auditing matters would be forwarded to the Chair of the Audit and Finance Committee for review.

4

Information Regarding Executive Officers

Set forth below is biographical and other information for our current executive officers, including their ages as of April 25, 2025. Information about Scott Maskin may be found above in this Amendment No. 1 under the heading “Information Regarding Directors.”

| Name | Age | Position | ||

| Scott Maskin | 61 | Chief Executive Officer | ||

| James Brennan | 60 | Chief Financial Officer and Chief Operating Officer | ||

| Kristin Hlavka | 43 | Chief Accounting Officer |

Mr. Brennan was appointed our Chief Financial Officer in March 2025 and Chief Operating Officer in May 2024. He was the Senior Vice President, Corporate Development from November 2022 to May 2024. From March 2015 to November 2022, he was the Chief Growth Officer at SUNation Energy.

Ms. Hlavka was appointed Chief Accounting Officer of SUNation Energy, Inc. in April 2025. She was previously the Corporate Controller since March 2022. Previously, she served as Corporate Controller of Communications Systems, Inc. from May 2011 to the Merger. Ms. Hlavka also served as our Interim Chief Financial Officer from August 22, 2022 until October 10, 2022. From July 2008 to April 2011, she served as the Assistant Corporate Controller of Communications Systems, Inc. Prior to July 2008, she was an auditor for Deloitte and Touche LLP.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC.

SEC regulations require us to identify anyone who filed a required report late during the most recent fiscal year. Based solely on a review of such reports and written information given to us by our directors and executive officers, we believe that all such required reports were filed on a timely basis under Section 16(a) for the fiscal year ended December 31, 2024.

ITEM 11. EXECUTIVE COMPENSATION

Overview

This section discusses our executive compensation objectives and policies, forms of compensation, and compensation related to services in 2024 paid to or earned by our named executive officers (the “NEOs”). The NEOs for 2024 were:

| ● | Scott Maskin, our Chief Executive Officer; |

| ● | Kyle Udseth, who served as Chief Executive Officer until May 2024; |

| ● | Andrew Childs, who served as Interim Chief Financial Officer until March 2025; |

| ● | Eric Ingvaldson, who served as Chief Financial Officer until August 2024; and |

| ● | James Brennan, our Chief Operating Officer and Chief Financial Officer effective March 2025. |

Compensation Objectives and Process

The Compensation Committee has designed the Company’s executive compensation program with a strategy to facilitate its ability to attract, retain, reward and motivate a high performing executive team. The Company’s compensation philosophy is based on a motivational plan to provide pay-for-performance (at both the individual and company levels), to enable the Company’s executive team to achieve the Company’s objectives successfully.

Our compensation programs are designed to:

| ● | attract and retain individuals with superior ability and managerial experience; |

5

| ● | align executive officers’ incentives with our corporate strategies, business objectives and the long-term interests of our shareholders; and |

| ● | increase the incentive to achieve key strategic performance measures by linking incentive award opportunities to the achievement of performance objectives and by providing a portion of total compensation for executive officers in the form of ownership in the Company. |

The Compensation Committee is primarily responsible for establishing and approving the compensation for all of our executive officers. The Compensation Committee oversees our compensation and benefit plans and policies, oversees and administers our equity incentive plans and reviews and approves annually all compensation decisions relating to all of our executive officers, including our Chief Executive Officer. The Compensation Committee considers recommendations from our Chief Executive Officer regarding the compensation of our executive officers other than himself. Our Compensation Committee has the authority under its charter to engage the services of a consulting firm or other outside advisor to assist it in designing our compensation programs and in making compensation decisions.

Compensation Decisions for 2024

The Compensation Committee evaluates and establishes the goals, objectives and substance of the Company’s executive compensation plans. The Compensation Committee has taken the following actions related to the components of executive compensation.

Base Salary

Mr. Udseth’s annual base salary of $300,000 was established in connection with his Employment Agreement entered into on February 10, 2021. Effective February 13, 2023, Mr. Udseth voluntarily agreed, and the Compensation Committee approved, a reduction in Mr. Udseth’s annual base salary to $255,000, in order to assist with the reduction of corporate overhead. Subsequently, in connection with certain financing arrangements entered into by the Company on June 1, 2023, the Compensation Committee approved the reinstatement of Mr. Udseth’s annual base salary amount of $300,000, effective June 5, 2023, which compensation remained the same through his resignation from employment with the Company in May 2024.

In connection with Mr. Ingvaldson’s appointment as the Company’s Chief Financial Officer effective October 10, 2022, the Compensation Committee approved an annual base salary of $250,000 for Mr. Ingvaldson, based on the Committee’s review of market salaries for similar positions, which remained the same through Mr. Ingvaldson’s resignation from employment with the Company in August 2024.

Ms. Hlavka’s annual base salary was established subsequent to the Merger at $185,000. During the time in 2022 when Ms. Hlavka served as our Interim Chief Financial Officer, her annual base salary was increased to $225,000, and then returned to $185,000 upon Mr. Ingvaldson’s appointment as the Company’s Chief Financial Officer, effective October 10, 2022, which compensation remained the same through 2024. On April 7, 2025 Ms. Hlavka was promoted to Chief Accounting Officer and Treasurer and her annual base salary was increased to $200,000.

On December 9, 2024, the Company entered into a written employment agreement with Mr. James Brennan as Chief Operating Officer (“COO”, which is prior to his additional previously announced role as Chief Financial Officer) for a three-year term, which provides for the following compensation terms: the COO will receive a base annual salary of $275,000, and Mr. Brennan shall be eligible for the potential bonus in 2025 of up to forty percent of his Base Salary, the latter of which is discretionary based on goals established by the Company’s Board and may be changed from time to time.

On December 10, 2024, the Company announced that the Board of Directors of the Company had determined to appoint its interim Chief Executive Officer, Scott Maskin, as the permanent Chief Executive Officer (“CEO”) of the Company, effective December 10, 2024. Mr. Maskin served as the Interim CEO since May 17, 2024. In connection with his appointment as the permanent CEO, the Company and Mr. Maskin entered into a written employment agreement (the “CEO Employment Agreement”) for a three-year term, which provides for an annual base salary of $295,000, and Mr. Maskin is eligible for the potential bonus in 2025 of up to fifty percent of his Base Salary, the latter of which is discretionary based on goals established by the Company’s Board and may be changed from time to time.

Annual Cash Incentive Program

In March 2024, the Compensation Committee approved performance metrics for the 2024 annual cash incentive program for the Company’s employees, including executive officers (the “2024 MIP”). Participants have the ability to earn between 50% of target for achieving threshold performance and 150% of target for achieving maximum performance for these metrics.

6

The following table presents the following for the 2024 MIP: (i) the performance measures for the plan; (ii) the relative weight assigned to each of the performance measures in determining overall performance against the plan; (iii) target achievement levels for each performance measure selected; and (iv) actual 2024 achievement as a percentage of the target goal.

| Performance Measure | % Weight | Annual Target Goal | % of Target Performance Achieved | |||||||||

| Consolidated Adjusted EBITDA | 30 | % | $ | 3,661,508 | -134 | % | ||||||

| Gross Profit | 30 | % | $ | 27,692,331 | 74 | % | ||||||

| Fundraising | 20 | % | $ | 25,000,000 | 10 | % | ||||||

| Business Acquisitions | 20 | % | 2 | 0 | % | |||||||

The Compensation Committee did not exercise any discretion to increase or decrease the amounts payable pursuant to the 2024 MIP as calculated pursuant to the terms as described above. The 2024 MIP was not earned for any of the performance measures as all achievements were below the minimum threshold. As a result, based on the results as applied to the 2024 MIP as described above, the 2024 MIP was not earned.

Equity Awards

A key component of an executive officer’s compensation is equity incentive awards, which are critical to focusing our executives on the Company’s long-term growth and creating shareholder value. In connection with the Merger,

the Company’s shareholders approved the Pineapple Holdings, Inc. 2022 Equity Incentive Plan (the “2022 Equity Incentive Plan”), which became effective on March 28, 2022. On December 7, 2022, and again on July 19, 2024, the Company’s shareholders approved amendments to the 2022 Equity Incentive Plan that increased the number of shares of common stock authorized for issuance under the 2022 Equity Incentive Plan to 67 shares of common stock (10,000,000 prior to the reverse stock splits).

During 2024, the Company effected two reverse stock splits and the shares available in the 2022 Equity Incentive Plan proportionally decreased as a result. As a result, there were no longer enough available shares to do meaningful awards to employees and the Company did not grant any equity awards to named executive officers in 2024.

Other Compensation

In addition to participating in Company-wide plans providing health, dental and life insurance on the same basis as all of our other employees, the NEOs receive other compensation and benefits in various forms, including an annual matching contribution of up to 50% of each executive’s personal contribution to the Company’s 401(k) Plan up to the first 6% of the personal contribution. The amount of this other compensation for our NEOs is presented in the column titled “All Other Compensation” under the “Summary Compensation Table” and the “All Other Compensation Table.”

7

SUMMARY COMPENSATION TABLE

The following table presents information regarding compensation paid to or earned by our NEOs for the years ended December 31, 2024 and 2023.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) (2) | All Other Compensation ($) (3) | Total ($) | |||||||||||||||||||

| Scott Maskin | 2024 | 263,704 | — | — | — | 11,160 | 274,864 | |||||||||||||||||||

| Chief Executive Officer(4)(8) | ||||||||||||||||||||||||||

| Andrew Childs | 2024 | 79,808 | — | — | — | 577 | 80,385 | |||||||||||||||||||

| Interim Chief Financial Officer(4)(7) | ||||||||||||||||||||||||||

| James Brennan | 2024 | 250,192 | — | — | — | 4,206 | 254,398 | |||||||||||||||||||

| Chief Operating Officer(4)(9) | ||||||||||||||||||||||||||

| Kristin Hlavka | 2024 | 188,588 | — | — | — | 6,925 | 195,483 | |||||||||||||||||||

| Corporate Controller | 2023 | 185,000 | — | 93,160 | 43,729 | 6,452 | 328,341 | |||||||||||||||||||

| Kyle J. Udseth | 2024 | 126,923 | — | — | — | 41,968 | 168,891 | |||||||||||||||||||

| Former Chief Executive Officer(5) | 2023 | 286,153 | — | 151,072 | 118,187 | 13,702 | 569,114 | |||||||||||||||||||

| Eric Ingvaldson | 2024 | 177,885 | — | — | — | 7,700 | 185,585 | |||||||||||||||||||

| Former Chief Financial Officer(6) | 2023 | 250,000 | — | 125,893 | 78,791 | 10,405 | 465,089 | |||||||||||||||||||

| (1) | Reflects the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for stock awards granted during the reported fiscal year. For additional information regarding the assumptions we used to calculate the amounts in this column, please refer to Note 11 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024. |

| (2) | Represents amounts earned under the annual cash incentive plan for the year indicated. |

| (3) | See “All Other Compensation Table” below. |

| (4) | None of Messrs. Maskin, Childs, or Brennan were NEOs in 2023. |

| (5) | Mr. Udseth served as our Chief Executive Officer until May 17, 2024. |

| (6) | Mr. Ingvaldson served as our Chief Financial Officer until August 28, 2024. |

| (7) | Mr. Childs served as our Interim Chief Financial Officer from August 28, 2024 until March 6, 2025. |

| (8) | On December 10, 2024, Mr. Maskin entered into a new employment agreement which provides for an annual base salary of $295,000. |

| (9) | On December 9, 2024, Mr. Brennan entered into a new employment agreement which provides for an annual base salary of $275,000. |

8

All Other Compensation Table

The following table provides a breakdown of information under the column “All Other Compensation” above.

| Employer Contributions to 401(k) Plan | Severance | Other | Total | |||||||||||||||

| Name | Year | ($) | ($)(1) | ($) | ($) | |||||||||||||

| Scott Maskin | 2024 | 9,660 | — | 1,500 | 11,160 | |||||||||||||

| Andrew Childs | 2024 | 577 | — | — | 577 | |||||||||||||

| James Brennan | 2024 | 4,206 | — | — | 4,206 | |||||||||||||

| Kristin Hlavka | 2024 | 6,925 | — | — | 6,925 | |||||||||||||

| 2023 | 6,452 | — | — | 6,452 | ||||||||||||||

| Kyle Udseth | 2024 | 7,353 | 34,615 | — | 41,968 | |||||||||||||

| 2023 | 10,835 | 2,867 | 13,702 | |||||||||||||||

| Eric Ingvaldson | 2024 | 7,548 | — | — | 11,233 | |||||||||||||

| 2023 | 7,548 | 2,856 | 11,233 | |||||||||||||||

| (1) | Mr. Udseth’s 2024 severance includes what was paid to him during 2024. He also received an additional $50,000 in 2025 as part of his separation from the Company. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information as of December 31, 2024 concerning outstanding equity awards held as of such date by our NEOs, as adjusted for the April 2025 Reverse Stock Split:

| Stock Awards | ||||||||

| Name | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($)(1) | ||||||

| Scott Maskin | 1 | (2) | 526 | |||||

| James Brennan | 1 | (2) | 526 | |||||

| Kristin Hlavka | 1 | (3) | 526 | |||||

| 1 | (4) | 526 | ||||||

| (1) | Market value is calculated by multiplying the number of unvested units by $526.00, the closing price of our common stock on December 31, 2024, as adjusted for the April 2025 Reverse Stock Split. |

| (2) | RSUs vest in thirds on each of November 15, 2023, November 15, 2024 and November 15, 2025. |

| (3) | RSUs vested in full on March 20, 2025 |

| (4) | RSUs vest in thirds on each of May 15, 2024, May 15, 2025, and May 15, 2026 |

9

EMPLOYMENT, TERMINATION AND CHANGE IN CONTROL ARRANGEMENTS

Employment Agreements

On December 5, 2022, the Company entered into an Employment Agreement with each of Mr. Udseth and Mr. Ingvaldson. Mr. Udseth’s Employment Agreement provides for, among other things, an annual base salary of $300,000. Mr. Udseth’s Employment Agreement also provided for his participation in the Company’s employee bonus program with a potential bonus opportunity of up to 50% of his base salary, and Mr. Udseth’s participation in the Company’s employee benefit plans and programs. Mr. Ingvaldson’s Employment Agreement provided for, among other things, an annual base salary of $250,000, Mr. Ingvaldson’s participation in the Company’s employee bonus program with a potential bonus opportunity of up to 40% of his base salary, and Mr. Ingvaldson’s participation in the Company’s employee benefit plans and programs.

Each of Mr. Udseth’s and Mr. Ingvaldson’s employment with the Company was on an at-will basis and continued until terminated by the Company, or resignation by the executive for any reason. Each of the Employment Agreements provided that upon termination of the executive’s employment, he is entitled to receive any base salary owed through his termination date and reimbursement of reasonable expenses incurred as of his termination date. If the executive’s employment is terminated by the Company for any reason other than Cause (as defined in the Employment Agreements) or disability, or by the executive for Good Reason (as defined in the Employment Agreements), in each case prior to a Change in Control (as defined in the change in control agreements referenced below), the executive would also be entitled to receive an amount equal to 50% of his annual base salary at that time, payable in equal installments over a six-month period.

Each Employment Agreement contained customary confidentiality provisions. It also provides that, while the executive is employed by us and for a period of six months thereafter, he will not engage in competitive business, subject to certain exceptions. The Employment Agreement also provides that, while the executive is employed by us and for a period of one year thereafter, he will not (i) solicit any customer or business partner of the Company; (ii) take any action intended to, or that has the effect of interfering with the Company’s relationship with any customer or business partner or otherwise resulting in a customer or business partner reducing or ceasing their business relationship with the Company; (iii) provide, to any customer with whom the executive had contact during employment or about whom he had access to confidential information, any products or services that are competitive with those that were offered by the Company during his employment with the Company; and (iv) directly or indirectly approach, solicit, entice, hire or attempt to approach, solicit entice or hire any employee of the Company to leave the employment of the Company.

Mr. Udseth’s Employment Agreement superseded and replaced the employment agreement, dated as of February 10, 2021, between Mr. Udseth and the Company, other than with respect to certain provisions as provided in Mr. Udseth’s Employment Agreement. Mr. Ingvaldson’s Employment Agreement supersedes and replaces the offer letter, dated as of September 16, 2022, between Mr. Ingvaldson and the Company.

10

Mr. Udesth’s employment with the Company ended in May 2024 upon his resignation from the Company, and no incentive or other bonus was earned or awarded under the terms of his employment contract, other than a mutually agreed upon $84,615 paid to Mr. Udseth upon his separation from the Company.

Mr. Ingvaldson’s employment with the Company ended in August 2024 upon his resignation from the Company, and no incentive or other bonus was earned or awarded under the terms of his employment contract.

Chief Executive Officer Employment Agreement

On December 10, 2024, the Board of Directors of the Company appointed its interim Chief Executive Officer, Scott Maskin, as the permanent Chief Executive Officer (“CEO”) of the Company. In connection with his appointment as the permanent CEO, the Company and Mr. Maskin entered into a written employment agreement (the “CEO Employment Agreement”) for a three-year term, which provides for a base annual salary of $295,000 (“Base Salary”), and Mr. Maskin shall be eligible for the potential bonus of up to fifty percent of his Base Salary, the latter of which is discretionary based on goals established by the Company’s Board and may be changed from time to time.

In addition, Mr. Maskin is entitled to participate in all employee benefit plans or programs offered by the Company to all its employees, subject to the eligibility requirements and terms of such plans or programs. Upon termination under the terms of the CEO Employment Agreement, Mr. Maskin shall be entitled to receive his Base Salary owed through the termination date, reimbursement of reasonable unpaid expenses incurred through such termination date.

The CEO Employment Agreement also provides for certain payments and benefits in the event of a termination of his employment under specific circumstances. If, during the term of the CEO Employment Agreement, his employment is terminated by the Company other than for “cause,” death or disability or by Mr. Maskin for “good reason” (each as defined in his agreement), he would be entitled to (i) pay or provide the Employee the benefits itemized in the CEO Employment Agreement, subject to the his signing and not rescinding a release of claims in a form acceptable to the Company, and he strictly complies with the terms of the agreement and any other written agreement between Mr. Maskin and the Company or any of its affiliates as of the date any installments described therein is to be paid, the Company shall pay to the CEO as severance pay a total amount equal to one hundred percent of the annual Base Salary as of the date of termination.

Pursuant to his employment agreement, Mr. Maskin has also agreed to customary restrictions with respect to the disclosure and use of the Company’s confidential information and has agreed that work product or inventions developed or conceived by him while employed with the Company relating to its business is the Company’s property. In addition, during the term of his employment and for the 12 month period following his termination of employment for any reason, Mr. Maskin has agreed not to, among other provisions, (1) perform services on behalf of a competing business which was the same or similar to the types services he was authorized, conducted, offered or provided to the Company, (2) solicit or induce any of the Company’s employees or independent contractors to terminate their employment with the Company, or (3) solicit any actual or prospective customers with whom he had material contact on behalf of a competing business.

11

Chief Operating Officer Employment Agreement

On December 9, 2024, the Company and Mr. James Brennan entered into a written employment agreement in connection with Mr. Brennan’s employment as Chief Operating Officer (the “COO Employment Agreement”) for a three-year term, which provides for a base annual salary of $275,000 (“Base Salary”), and Mr. Brennan shall be eligible for the potential bonus of up to forty percent of his Base Salary, the latter of which is discretionary based on goals established by the Company’s Board and may be changed from time to time.

In addition, Mr. Brennan is entitled to participate in all employee benefit plans or programs offered by the Company to all its employees, subject to the eligibility requirements and terms of such plans or programs. Upon termination under the terms of the COO Employment Agreement, Mr. Brennan shall be entitled to receive his Base Salary owed through the termination date, reimbursement of reasonable unpaid expenses incurred through such termination date.

The COO Employment Agreement also provides for certain payments and benefits in the event of a termination of his employment under specific circumstances. If, during the term of the COO Employment Agreement, his employment is terminated by the Company other than for “cause,” death or disability or by Mr. Brennan for “good reason” (each as defined in his agreement), he would be entitled to (i) pay or provide the Employee the benefits itemized in the COO Employment Agreement, subject to the his signing and not rescinding a release of claims in a form acceptable to the Company, and he strictly complies with the terms of the agreement and any other written agreement between Mr. Brennan and the Company or any of its affiliates as of the date any installments described therein is to be paid, the Company shall pay to the COO as severance pay a total amount equal to one hundred percent of the annual Base Salary as of the date of termination.

Pursuant to his employment agreement, Mr. Brennan has also agreed to customary restrictions with respect to the disclosure and use of the Company’s confidential information, and has agreed that work product or inventions developed or conceived by him while employed with the Company relating to its business is the Company’s property. In addition, during the term of his employment and for the 12 month period following his termination of employment for any reason, Mr. Brennan has agreed not to, among other provisions, (1) perform services on behalf of a competing business which was the same or similar to the types services he was authorized, conducted, offered or provided to the Company, (2) solicit or induce any of the Company’s employees or independent contractors to terminate their employment with the Company, or (3) solicit any actual or prospective customers with whom he had material contact on behalf of a competing business.

2022 Equity Incentive Plan and Award Agreements

Under the 2022 Equity Incentive Plan and related award agreements:

| ● | if a participant is terminated for cause or upon conduct that would constitute cause during any post-termination exercise period, all unexercised option awards and all unvested portions of any other outstanding awards will be immediately forfeited without consideration; |

| ● | if a participant’s service is terminated due to his or her death or disability, (i) all unvested restricted stock units shall vest as of the termination date, (ii) unvested performance stock units will vest on a pro rata basis, based on the actual performance in the case of disability and the target performance in the case of death; and (iii) the currently vested and exercisable portions of option awards may be exercised for a period of one year after the date of such termination; and |

| ● | upon termination for any reason other than death, disability or cause, all unvested and unexercisable portions of any outstanding awards will be immediately forfeited without consideration and the currently vested and exercisable portions of option awards may be exercised for a period of three months after the date of such termination; however, if a participant thereafter dies during such three-month period, the vested and exercisable portions of the option awards may be exercised for a period of one year after the date of such termination. |

12

The 2022 Equity Incentive Plan and related award agreements provide that if either of the following occurs: (1) there is a change in control of our company that involves a corporate transaction, the outstanding awards are continued, assumed or replaced by the surviving or successor entity, and within 24 months after the corporate transaction a participant’s employment or other service is involuntarily terminated without cause, or (2) there is a change in control of our company that does not involve a corporate transaction and within 24 months after the change in control a participant’s employment or other service is involuntarily terminated without cause, then (i) each of the participant’s outstanding options will become fully vested and exercisable and will remain exercisable for one year, and (ii) each of the participant’s unvested full value awards will fully vest. To the extent vesting of any award continued, assumed or replaced is subject to satisfaction of specified performance goals, the number of units that would vest will be equal to (A) if the accelerated vesting event occurs before the last day of the performance period, the target number of units, prorated based on the period of time during the performance period prior to the termination, or (B) if the accelerated vesting event occurs on or after the last day of the performance period, the number of units will be determined based on the actual level of achievement of the performance goals.

The 2022 Equity Incentive Plan and related award agreements also provide that if any outstanding award is not continued, assumed or replaced in connection with a change in control involving a corporate transaction, then (i) all outstanding options and SARs will become fully vested and exercisable for a period of time prior to the effective time of the corporate transaction and will then terminate at the effective time of the corporate transaction, and (ii) all full value awards will fully vest. For these purposes, for a performance-based award, the number of units that would vest will be equal to (A) if the accelerated vesting event occurs before the last day of the performance period, the target number of units, prorated based on the period of time during the performance period prior to the corporate transaction, or (B) if the accelerated vesting event occurs on or after the last day of the performance period, the number of units will be determined based on the actual level of achievement of the performance goals set forth in the agreement. Alternatively, if outstanding awards are not continued, assumed or replaced, the Compensation Committee may elect to cancel such awards at or immediately prior to the effective time of the corporate transaction in exchange for a payment with respect to each award in an amount equal to the excess, if any, between the fair market value of the consideration that would otherwise be received in the corporate transaction for the same number of shares over the aggregate exercise price (if any) for the shares subject to such award (or, if there is no excess, such award may be terminated without payment).

For purposes of the 2022 Equity Incentive Plan, the following terms have the meanings indicated:

| ● | a “change in control” generally refers to the acquisition by a person or group of beneficial ownership of more than 50% of the combined voting power of our voting securities, our continuing directors ceasing to constitute a majority of the board of directors, or the consummation of a corporate transaction as defined below (unless immediately following such corporate transaction all or substantially all of our previous holders of voting securities beneficially own more than 50% of the combined voting power of the resulting entity in substantially the same proportions); and |

| ● | a “corporate transaction” generally means (i) a sale or other disposition of all or substantially all of our assets, or (ii) a merger, consolidation, share exchange, or similar transaction involving us, regardless of whether we are the surviving entity. |

INCENTIVE COMPENSATION RECOVERY POLICY

The Board has adopted a Compensation Recovery Policy (the “Clawback Policy”), effective October 2, 2023, in compliance with the listing standards of Nasdaq. The Clawback Policy provides that promptly following an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period), the Compensation Committee will determine the amount of the excess of the amount of incentive-based compensation received by Section 16 officers during the three completed fiscal years immediately preceding the required restatement date over the amount of incentive-based compensation that otherwise would have been received had it been determined based on the restated amounts. The Company will provide each such officer with a written notice of such amount and a demand for repayment or return. If such repayment or return is not made within a reasonable time, the Clawback Policy provides that the Company will recover the erroneously awarded compensation in a reasonable and prompt manner using any lawful method, subject to limited exceptions as permitted by Nasdaq listing standards.

13

PAY VERSUS PERFORMANCE

The following table sets forth additional compensation information of our Chief Executive Officer (referred to as our “PEO” in this section) and of the average of our other NEOs (the “Non-PEO NEOs”) along with total shareholder return and net loss for 2024, 2023 and 2022:

| Year | Summary Compensation Table Total for 2024 PEO(1) ($) | Compensation Actually Paid to 2024 PEO(2) ($) | Summary Compensation Table Total for Former PEO(1) | Compensation Actually Paid to Former PEO(2) | Summary Compensation Table Total for Former PEO (1) | Compensation Actually Paid to Former PEO(2) | Average Summary Compensation Table Total for Non-PEO NEOs (1) ($) | Average Compensation Actually Paid to Non-PEO NEOs (2) ($) | Value of Initial Fixed $100 Investment Based on: Total Shareholder Return (3) ($) | Net Income (Loss) ($) | ||||||||||||||||||||||||||||||

| 2024 | — | — | ( | ) | ||||||||||||||||||||||||||||||||||||

| 2023 | — | — | — | — | ( | ) | ||||||||||||||||||||||||||||||||||

| 2022 | — | — | ( | ) | ||||||||||||||||||||||||||||||||||||

| (1) |

| (2) |

| (3) |

14

| Adjustments | 2024 PEO ($) | Former PEO (Udseth) ($) | Average of Non-PEO NEOs ($) | |||||||||

| Total 2024 Compensation from SCT | ||||||||||||

| Subtraction: Stock Awards and Option Awards reported in SCT | ||||||||||||

| Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at covered year-end | ||||||||||||

| Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at covered year-end | ( | ) | ( | ) | ||||||||

| Addition: Vesting date fair value of awards granted and vesting during the covered year | ||||||||||||

| Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during the covered year* | ( | ) | ( | ) | ( | ) | ||||||

| (Subtraction): Fair value at end of prior year of awards granted in any prior fiscal year that failed to meet the applicable vesting conditions during the covered year | ( | ) | ( | ) | ||||||||

| Addition: Dividends or other earnings paid on stock or option awards in the covered year prior to vesting if not otherwise included in the total compensation for the covered year | ||||||||||||

| Compensation Actually Paid for 2024 (as calculated) | ||||||||||||

| Adjustments | Former PEO (Udseth) ($) | Average of Non-PEO NEOs ($) | ||||||

| Total 2023 Compensation from SCT | ||||||||

| Subtraction: Stock Awards and Option Awards reported in SCT | ||||||||

| Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at covered year-end | ||||||||

| Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at covered year-end | ( | ) | ( | ) | ||||

| Addition: Vesting date fair value of awards granted and vesting during the covered year | ||||||||

| Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during the covered year | ( | ) | ( | ) | ||||

| (Subtraction): Fair value at end of prior year of awards granted in any prior fiscal year that failed to meet the applicable vesting conditions during the covered year | ||||||||

| Addition: Dividends or other earnings paid on stock or option awards in the covered year prior to vesting if not otherwise included in the total compensation for the covered year | ||||||||

| Compensation Actually Paid for 2023 (as calculated) | ||||||||

15

| Adjustments | Former PEO (Udseth) ($) | Former PEO (Lacey) ($) | Average of Non-PEO NEOs ($) | |||||||||

| Total 2022 Compensation from SCT | ||||||||||||

| Subtraction: Stock Awards and Option Awards reported in SCT and value of “Acceleration of Stock Options and Restricted Stock Units” as reported in SCT under All Other Compensation* | ||||||||||||

| Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at covered year-end | ||||||||||||

| Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at covered year-end | ||||||||||||

| Addition: Vesting date fair value of awards granted and vesting during the covered year | ||||||||||||

| Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during the covered year | ||||||||||||

| (Subtraction): Fair value at end of prior year of awards granted in any prior fiscal year that failed to meet the applicable vesting conditions during the covered year | ||||||||||||

| Addition: Dividends or other earnings paid on stock or option awards in the covered year prior to vesting if not otherwise included in the total compensation for the covered year | ||||||||||||

| Compensation Actually Paid for 2022 (as calculated) | ||||||||||||

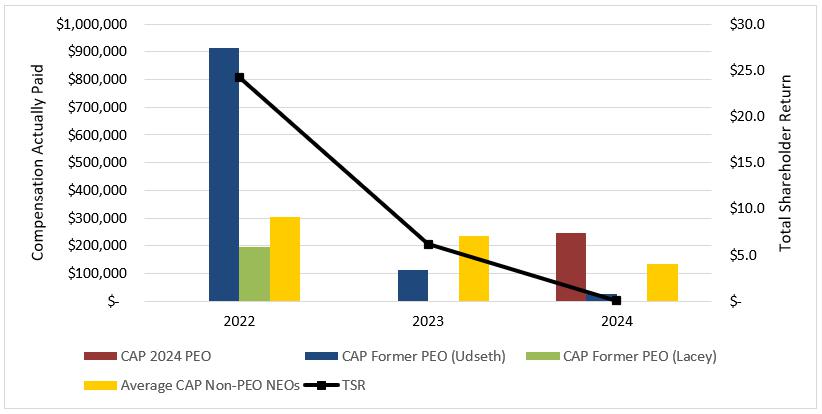

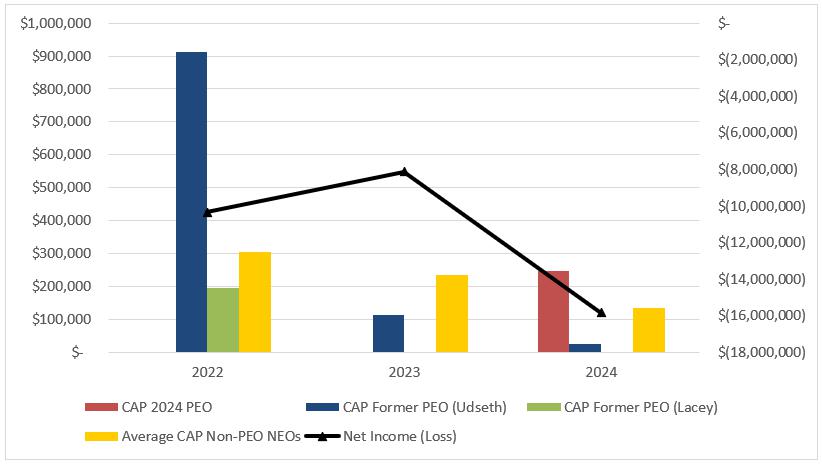

Relationship between Pay and Performance

Our executive compensation program seeks to align executive officers’ long-term interests with those of our shareholders to incentivize a long-term increase in shareholder value, and therefore does not specifically align the Company’s performance measures with Compensation Actually Paid (“CAP”) (as defined by SEC rules) for a particular year. In accordance with Item 402(v) of Regulation S-K, we are providing the following graphic descriptions of the relationships between information presented in the Pay Versus Performance table above, for each the three years ended December 31, 2024. The following graphs address the relationship between compensation “actually paid” as disclosed in the Pay vs. Performance Table for our PEOs and the average amounts for the non-PEO NEOs and (1) the Company’s cumulative TSR and (2) the Company’s net income (loss).

16

Compensation Actually Paid vs TSR

Compensation Actually Paid vs Net Income (Loss)

DIRECTOR COMPENSATION

In 2024, the annual compensation payable to non-employee directors of the Board, payable on a quarterly basis on the first day, or as soon as practicable after the first day, of each quarter:

| ● | $30,000 cash retainer for all non-employee directors; |

17

| ● | $7,500 additional cash retainer to each chair of a committee of the Board; |

| ● | $5,000 additional cash retainer for service on each committee of the Board, excluding the chair of such committee; and |

| ● | $15,000 additional cash retainer to the chair of the Board. |

While non-employee directors received an annual grant of RSUs in 2022, the RSU grant initially intended for 2023 was not made until early 2024. As a result, our non-employee directors did not receive any equity awards in 2023. During 2024, the Company effected two reverse stock splits and the shares available in the 2022 Equity Incentive Plan proportionally decreased as a result. As a result, there were no longer enough available shares to do meaningful equity awards and the Company did not grant any equity awards to directors in 2024.

The following table sets forth summary information concerning the compensation earned by our directors for the fiscal year ended December 31, 2024. Compensation paid to or earned by Mr. Maskin and Mr. Udseth, who served as a director and was an NEO during the fiscal year ended December 31, 2024, is set forth in the Summary Compensation Table.

| Fees Earned or Paid in Cash | Stock Awards (1) | All Other Compensation | Non-Equity Incentive Plan Compensation | Total | ||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | |||||||||||||||

| Marilyn S. Adler | 22,500 | 8,850 | — | — | 31,350 | |||||||||||||||

| Thomas J. Holland | 23,750 | 8,850 | — | — | 32,600 | |||||||||||||||

| Spring Hollis | 11,875 | — | — | — | 11,875 | |||||||||||||||

| Scott M. Honour | 26,563 | 8,850 | — | — | 35,413 | |||||||||||||||

| Henry Howard | 23,750 | — | — | — | 23,750 | |||||||||||||||

| Roger C. Lacey | 45,000 | 8,850 | — | — | 65,100 | |||||||||||||||

| Kevin O’Connor | 23,750 | — | — | — | 23,750 | |||||||||||||||

| Randall D. Sampson | 21,250 | — | — | — | 21,250 | |||||||||||||||

| (1) | Reflects the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for stock awards granted during the reported fiscal year. For additional information regarding the assumptions we used to calculate the amounts in this column, please refer to Note 11 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024. |

18

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Ownership of Certain Beneficial Owners and Management

The following table and accompanying footnotes set forth certain information regarding the beneficial ownership of the Company’s voting stock and Common Stock by (i) each person known by the Company to beneficially own more than 5% of our voting stock or Common Stock, (ii) each current executive officer and director of the Company, (iii) each of the Named Executive Officers of the Company for the fiscal year ended December 31, 2024, and (iv) all current executive officers and directors of the Company as a group, in each case based upon information available to the Company as of December 31, 2024. Percentage ownership is based on 3,406,614 shares of our common stock outstanding as of April 25, 2024. Unless otherwise noted, the address of each person is 171 Remington Boulevard, Ronkonkoma, NY 11779.

Beneficial ownership is determined in accordance with SEC rules. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and include shares of Common Stock issuable upon the exercise of options, warrants, preferred stock, and other securities that are immediately exercisable or convertible, or exercisable or convertible within 60 days of April 25, 2025. Except as otherwise indicated, all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them, subject to applicable community property laws. The information is not necessarily indicative of beneficial ownership for any other purpose.

| Beneficial Owner | Number of Shares of Common Stock | Percentage of Shares of Common Stock | ||||||

| Roger H.D. Lacey | 11 | * | ||||||

| Scott Maskin | 23 | * | ||||||

| Spring Hollis | 14 | * | ||||||

| Henry Howard | — | — | ||||||

| Kevin O’Connor | 2 | * | ||||||

| James Brennan | 14 | * | ||||||

| Kristin Hlavka(1) | 2 | * | ||||||

| Andrew Childs(2) | — | — | ||||||

| Kyle Udseth(3) | — | — | ||||||

| Eric Ingvaldson(4) | — | — | ||||||

| All current executive officers and directors as a group (7 persons) | 66 | * | ||||||

| * | Less than one percent |

| (1) | Includes 1 shares held by Ms. Hlavka directly and 1 RSUs that vest within 60 days of April 25, 2025. |

| (2) | Based on information available to the Company. Mr. Childs, the Company’s former Interim Chief Financial Officer, was a Named Executive Officer of the Company during the fiscal year ended December 31, 2024. |

| (3) | Based on information available to the Company. Mr. Udseth, the Company’s former Chief Executive Officer, was a Named Executive Officer of the Company during the fiscal year ended December 31, 2024. |

| (4) | Based on information available to the Company. Mr. Ingvaldson, the Company’s former Chief Financial Officer, was a Named Executive Officer of the Company during the fiscal year ended December 31, 2024. |

19

SELECTED FINANCIAL DATA

On April 3, 2025, the Company’s stockholders approved a reverse stock split of the Company’s common stock at a ratio within a range of 1-for-2 and 1-for-200 and granted the Company’s board of directors the discretion to determine the timing and ratio of the split within such range. Additionally, the shareholders also approved an increase in authorized shares to 1,000,000,000 shares. On April 9, 2025, the Company’s board of directors determined to effect the reverse stock split of the common stock at a 1-for-200 ratio (the “April Reverse Stock Split”) and approved an amendment to its Certificate of Incorporation. Effective April 16, 2025, the Company amended its Certificate of Incorporation to implement a one-for-two hundred reverse stock split. As a result of the reverse stock split, at 12:01 a.m. Eastern Time on April 21, 2025, every 200 shares of common stock then issued and outstanding automatically were combined into one share of common stock, with no change in par value per share. No fractional shares were outstanding following the reverse stock split, and any fractional shares that would have resulted from the reverse stock split were rounded up to the nearest whole share.

We have not restated any prior financial statements or financial information incorporated by reference in this Annual Report on Form 10-K/A to reflect the reverse stock split. The following selected financial data is based on common stock and per share data from our Annual Report on Form 10-K for the year ended December 31, 2024 as retrospectively adjusted to reflect the reverse stock split.

| Year Ended December 31 | ||||||||

| 2024 | 2023 | |||||||

| Weighted average shares outstanding - basic and diluted | 2,714 | 67 | ||||||

| Loss per share from continuing operations - basic and diluted | $ | (10,110.93 | ) | $ | (103,916.17 | ) | ||

| Loss per share from discontinued operations - basic and diluted | $ | - | $ | (17,852.82 | ) | |||

20

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

SUNation Acquisition

On November 9, 2022, the Company acquired all of the issued and outstanding equity of SUNation Solar Systems, Inc. and five of its affiliated entities (“SUNation”), directly or indirectly from SUNation’s owners, which included Scott Maskin and James Brennan (with the other two owners, Scott Sousa and Brian Karp, collectively, the “Sellers”). Mr. Maskin was appointed a director of the Company and the Senior Vice President and General Manager, New York Division, of the Company, received 3 shares (513,300 shares prior to the reverse stock splits) of Company common stock as consideration in the transaction and was granted an inducement award of 1 restricted stock unit (69,091 restricted stock units prior to the reverse stock splits) in connection with his employment with the Company. Mr. Brennan was appointed Senior Vice President, Corporate Development, of the Company, received 3 shares (494,007 shares prior to the reverse stock splits) of Company common stock as consideration in the transaction and was granted an inducement award of 3 restricted stock units (65,455 restricted stock units prior to the reverse stock splits) in connection with his employment with the Company.

The terms of Mr. Maskin’s and Mr. Brennan’s current Employment Agreements are set forth above under “Employment Agreements.”

The Company acquired SUNation from the Sellers for an aggregate purchase price of $18,440,533, comprised of (a) $2,390,000 in cash consideration paid at closing, (b) the issuance at closing of a $5,000,000 Short-Term Limited Recourse Secured Promissory Note payable to Messrs. Maskin and Brennan (the “Short-Term Note”), (c) the issuance at closing of a $5,486,000 Long-Term Promissory Note payable to Messrs. Maskin and Brennan (the “Long-Term Note”), with a fair value of $4,830,533 at the acquisition date, and (d) the issuance at closing of an aggregate of 1,480,000 shares of Company common stock. The purchase price also includes potential earn-out payments of up to $5,000,000 in the aggregate based on the percentage of year-over-year EBITDA growth of the SUNation businesses in 2023 and 2024.

The Short-Term Note was paid in full on June 1, 2023. The Long-Term Note was unsecured and initially matured on November 9, 2025. On April 10, 2025, the original Long-Term Note was amended and restated as follows: The principal amount of $5,486,000 previously due and payable under the original Long Term Note, together with all accrued and unpaid interest owing thereunder, shall be due and payable on May 1, 2028 (the “Maturity Date”), and such amended note shall become a senior secured instrument. Principal and interest payments under the amended Long-Term Note shall be payable monthly on the first day of each month commencing with June 1, 2025 for thirty-six (36) consecutive months thereafter pursuant to the terms thereunder. Additionally, pursuant to the terms of that certain Senior Secured Contingent Note Instrument, entered into on April 10, 2025, the unearned 2024 earnout was rescheduled and shall be based on the earnout terms set forth therein pursuant to the financial conditions and terms covering each of fiscal years 2024 and 2025 and, if attained, shall be payable over a period of 24 months beginning in fiscal year 2026, which payment is further conditioned on the continued employment of the note holders at the time of such earnout payment trigger date.

General

The Company’s Board has adopted Governance Guidelines that include provisions with respect to conflicts of interest. These Guidelines describe a “conflict of interest” as a situation in which a director’s personal interest, including an immediate family member interest, is adverse to, or may appear to be adverse to, the interests of the Company. The Guidelines provide that any situation that involves, or may reasonably be expected to involve, a conflict of interest with the Company, must be disclosed promptly to the Chief Executive Officer, the Chairman, and the Company’s primary legal counsel.

If the Company wishes to proceed with a transaction involving a potential conflict of interest, the Board would intend to seek prior approval from the Audit and Finance Committee to ensure the transaction is beneficial to the Company and the terms of the transaction are fair to the Company.

21

Executive Compensation and Employment Arrangements

Information on compensation arrangements with the Company’s executive officers is described in detail in Part III, Item 11. “Executive Compensation” in this Amendment No. 1.

DIRECTOR INDEPENDENCE

Under the Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our Board of Directors has affirmatively determined that, as currently constructed, all of our directors, except for Mr. Maskin, are independent directors within the meaning of the applicable Nasdaq listing standards. Messrs. Udseth and Lacey, were not deemed to be independent directors during 2024.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Fees of Independent Registered Public Accounting Firm

The following is a summary of the fees billed to the Company by UHY for professional services for the years ended December 31, 2024 and 2023:

| Fee Category | 2024 | 2023 | ||||||

| Audit Fees | $ | 745,850 | $ | 467,875 | ||||

| Audit-Related Fees | — | — | ||||||

| Tax Fees | — | — | ||||||

| All Other Fees | — | — | ||||||

| Total Fees | $ | 745,850 | $ | 467,875 | ||||

Audit Fees. This category consists of fees billed for professional services rendered for the audit of the Company’s annual financial statements and review of financial statements included in our quarterly reports.

Audit-Related Fees. This category consists of fees billed for assurance and related services, such as the Company’s employee benefit plan audits that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not otherwise reported under “Audit Fees.”

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and tax planning. Assistance regarding federal and state tax compliance and acquisitions are provided to the Company by RSM US LLP.

All Other Fees. All other fees are fees for products and services other than those listed above.

Audit and Finance Committee Pre-Approval Policies and Procedures

In addition to approving the engagement of the independent registered public accounting firm to audit the Company’s consolidated financial statements, the policy of the Audit and Finance Committee is to approve all use of the Company’s independent registered public accounting firm for non-audit services prior to any such engagement. To minimize relationships that could appear to impair the objectivity of the independent registered public accounting firm, the policy of the Committee is to restrict the non-audit services that may be provided to the Company by the Company’s independent registered public accounting firm primarily to tax services, merger and acquisition due diligence and integration services, and any other services that can clearly be designated as “non-audit” services. All of the services described above for 2024 and 2023 were pre-approved by the Audit and Finance Committee before UHY, were engaged to render the services.

22

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a)(1) Consolidated Financial Statements

The following Consolidated Financial Statements of SUNation Energy, Inc. and subsidiaries appear at pages 44 to 84 in the Original Filing:

| ● | Report of Independent Registered Public Accounting Firm |

| ● | Report of Independent Registered Public Accounting Firm |

| ● | Consolidated Balance Sheets as of December 31, 2024 and 2023 |

| ● | Consolidated Statements of Operations and Comprehensive Loss for the years ended December 31, 2024 and 2023 |

| ● | Consolidated Statements of Changes in Stockholders’ Equity for the years ended December 31, 2024 and 2023 |

| ● | Consolidated Statements of Cash Flows for the years ended December 31, 2024 and 2023 |

| ● | Notes to Consolidated Financial Statements |

(a)(2) Consolidated Financial Statement Schedules

The schedules have been omitted as the required information is inapplicable or the information is otherwise included in the Original Filing.

(a)(3) Exhibits

See Exhibit Index, which is incorporated herein by reference.

23

| 3.2 | Bylaws SUNation Energy, Inc. | Filed as Exhibit 3.2 to the Form 8-K filed on November 19, 2024 and incorporated herein by reference. | |